Ambrus Grows Portfolio with $31M Tampa Condo Acquisition

August 29, 2025

Kennedy Wilson Expands Multifamily Platform with Acquisition of Toll Brothers Apartment Living

September 26, 202540 Years of Growth: Home Prices Surpass Income Gains

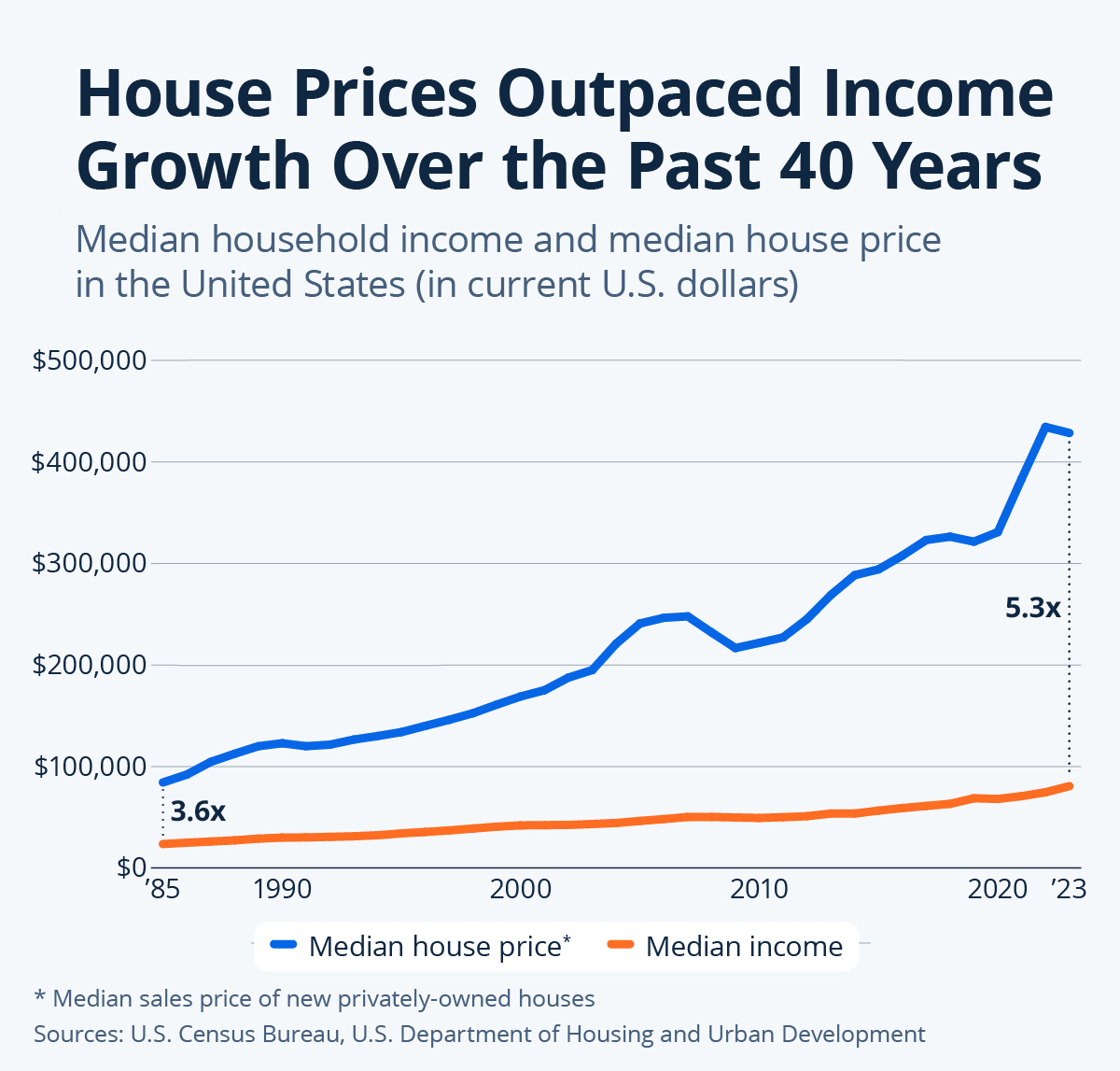

Housing affordability in the United States has worsened in recent years. Home prices climbed to record highs during and after the pandemic, while mortgage rates reached levels not seen since the early 2000s as the Federal Reserve raised interest rates to bring inflation under control.

The shift began during the COVID-19 pandemic when demand for housing surged. Many Americans, supported by government stimulus and new flexibility to work remotely, began seeking more space or new living arrangements. At the same time, mortgage rates fell to historic lows, which fueled even greater demand. Supply, however, remained limited. Construction faced pandemic-related disruptions, and many potential sellers held back during a time of uncertainty. This imbalance caused home prices to rise quickly across the country, and affordability declined further when the Fed began tightening policy in 2022.

Over the long term, affordability has been on a steady decline. In 1985, the median household income was $23,620, while the median price of a new home was $84,300, about 3.6 times income. By 2000, the ratio of home prices to income reached 4, and by 2023 it had risen to 5.3. During that period, median household income increased 241 percent in nominal terms to $80,610, but home prices grew at a much faster pace, rising 408 percent to $428,600.