Coregiving 2022

August 4, 2022

Coregiving Play FORE 2022 Golf Event

August 18, 2022CBRE Reports That The Multifamily Sector Saw a 32% YOY Increase In Volume In The Second Quarter

Commercial real estate investment increased 10% year over year in the second quarter to $167 billion, according to CBRE’s latest Capital Markets Figures report. Multifamily topped the commercial real estate sectors with $78 billion in investment volume, a 32% year-over-year increase. Industrial and logistics, down 1% from a year ago, followed by $32 billion. The office was down 9% yearly, coming in at $24 billion, while retail saw a 41% increase at $21 billion.

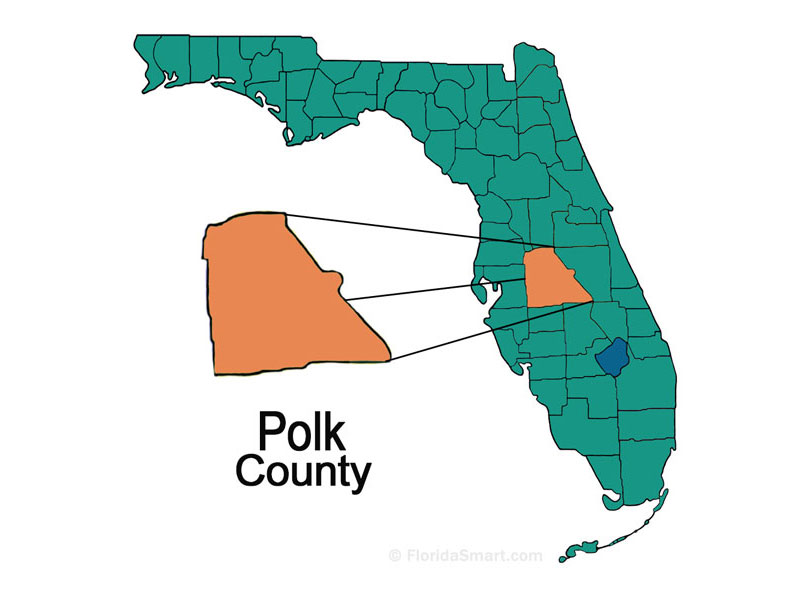

For multifamily, Houston experienced 220% growth over the trailing four-quarter period ending in the second quarter, followed by Orlando, Florida; Seattle; Las Vegas; and Nashville, Tennessee. South Florida; Raleigh/Durham, North Carolina; Philadelphia; San Diego; and Indianapolis rounded out the top 10.

Inbound cross-border investment volume increased 16% year over year in the second quarter to $6.5 billion. However, it was down 9% from the first quarter due to the strengthening dollar. Canada accounted for $24 billion, or 37%, of the second quarter total for U.S. inbound cross-border investment, followed by Singapore with $14 billion and South Korea with $5 billion.

CBRE also reported that the Real Capital Analytics Commercial Property Price Index rose 18.5% year over year in the second quarter. The industrial sector saw the biggest increase, 27%, in property prices, followed by multifamily at 24%.

Source - Multifamily Executive