Commercial and Multifamily Borrowing Surges 59% in Q3

November 19, 2024

Essential Features to Look for in Modern Door Locks

November 26, 2024Pros for the Multifamily Industry in 2025

The multifamily housing industry is poised for another dynamic year in 2025. Economic shifts, emerging trends, and technological advancements will present both opportunities and challenges for property managers nationwide. Here’s a look at the key pros and cons facing the industry in the coming year—and how property managers can prepare to adapt.

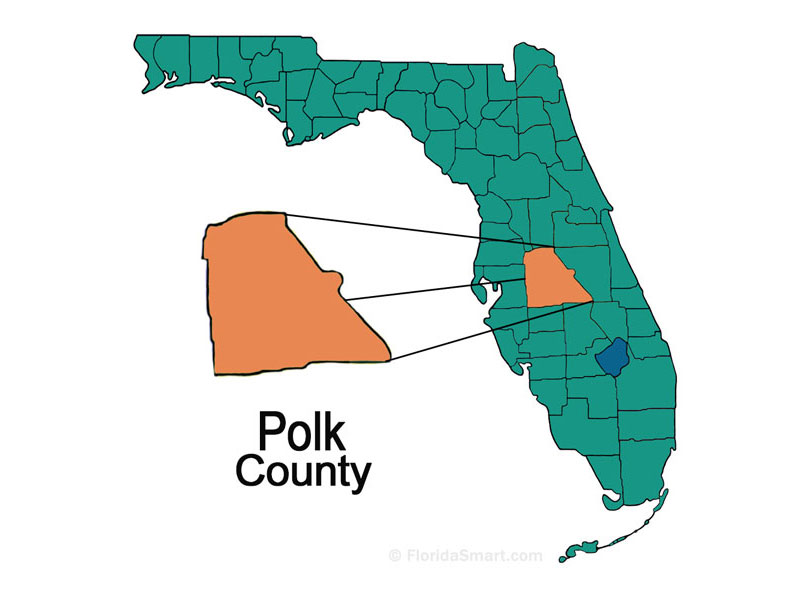

1. Continued Demand for Multifamily Housing

The demand for multifamily housing remains strong, driven by population growth in urban and suburban areas, increasing rental preferences, and the ongoing affordability crisis in single-family homeownership. Property managers in high-demand areas may see stable or increasing occupancy rates, leading to stronger revenue streams.

2. Emphasis on Sustainability

Sustainability continues to be a top priority. Tenants, especially Millennials and Gen Z renters, are seeking eco-friendly living options. Multifamily properties that incorporate green features—such as energy-efficient appliances, EV charging stations, and water-saving systems—can command premium rents and reduce operating costs.

3. Technological Advancements

Smart home technology, AI-driven tenant management systems, and advanced maintenance tools are improving operational efficiency and tenant satisfaction. Automated platforms for rent collection, leasing, and communication save time and reduce errors for property managers, allowing them to focus on strategic improvements.

4. Federal and State Incentives

Governments are increasingly offering incentives for affordable housing development and renovation. Tax credits and grants for properties that meet specific criteria could provide financial relief for property owners and property managers.

Cons for the Multifamily Industry in 2025

1. Rising Interest Rates

High interest rates continue to increase borrowing costs, making it more expensive to finance new developments or renovations. Property managers may feel the pressure to optimize existing properties to maintain profitability.

2. Labor Shortages

The construction and property management industries are facing persistent labor shortages. Property managers might encounter delays in completing renovations, maintenance, or tenant turnover tasks, impacting operational efficiency.

3. Regulatory Challenges

Cities across the U.S. are tightening rent control regulations and tenant protection laws. While these aim to create fair housing, they could also limit the flexibility property managers have in setting competitive rents or addressing lease violations.

4. Increased Competition

As the multifamily market grows, new developments and updated properties are flooding the market, creating intense competition. Property managers will need to work harder to differentiate their properties and attract long-term tenants.

Streamlining Staff Involvement

How These Trends Will Affect Property Managers

Property managers stand at the intersection of these pros and cons, directly feeling their impact. Here’s how they might adapt:

Leveraging Technology: Embracing property management software and smart building technologies will be critical. These tools not only streamline operations but also enhance the tenant experience, giving properties a competitive edge.

Focusing on Retention: With increased competition, retaining tenants will be more important than ever. Property managers should invest in customer service, community-building efforts, and responsive maintenance to foster tenant loyalty.

Navigating Regulations: Staying informed about changing local laws is crucial. Property managers may need to work closely with legal advisors and industry organizations to ensure compliance and minimize risk.

Prioritizing Efficiency: Rising costs mean property managers must seek ways to do more with less. Energy-efficient upgrades, preventive maintenance, and optimized staffing can reduce expenses while maintaining quality service.

Adapting to Sustainability Trends: Highlighting green initiatives and certifications can help attract eco-conscious renters and improve marketability.

The Takeaway

The multifamily industry in 2025 will demand resilience, innovation, and adaptability from property managers across the U.S. While challenges such as rising costs and labor shortages loom large, the potential for growth through technology, sustainability, and demand remains strong. By staying proactive and informed, property managers can turn these challenges into opportunities and ensure long-term success in the evolving multifamily market.