Johns Hopkins to Start Construction on Pasco Children’s Hospital

January 10, 2025

2025 Inspire, The FAA (Florida Apartment Association) Annual Conference and Trade Show

January 17, 2025Setting Expectations for 2025 Multifamily Performance

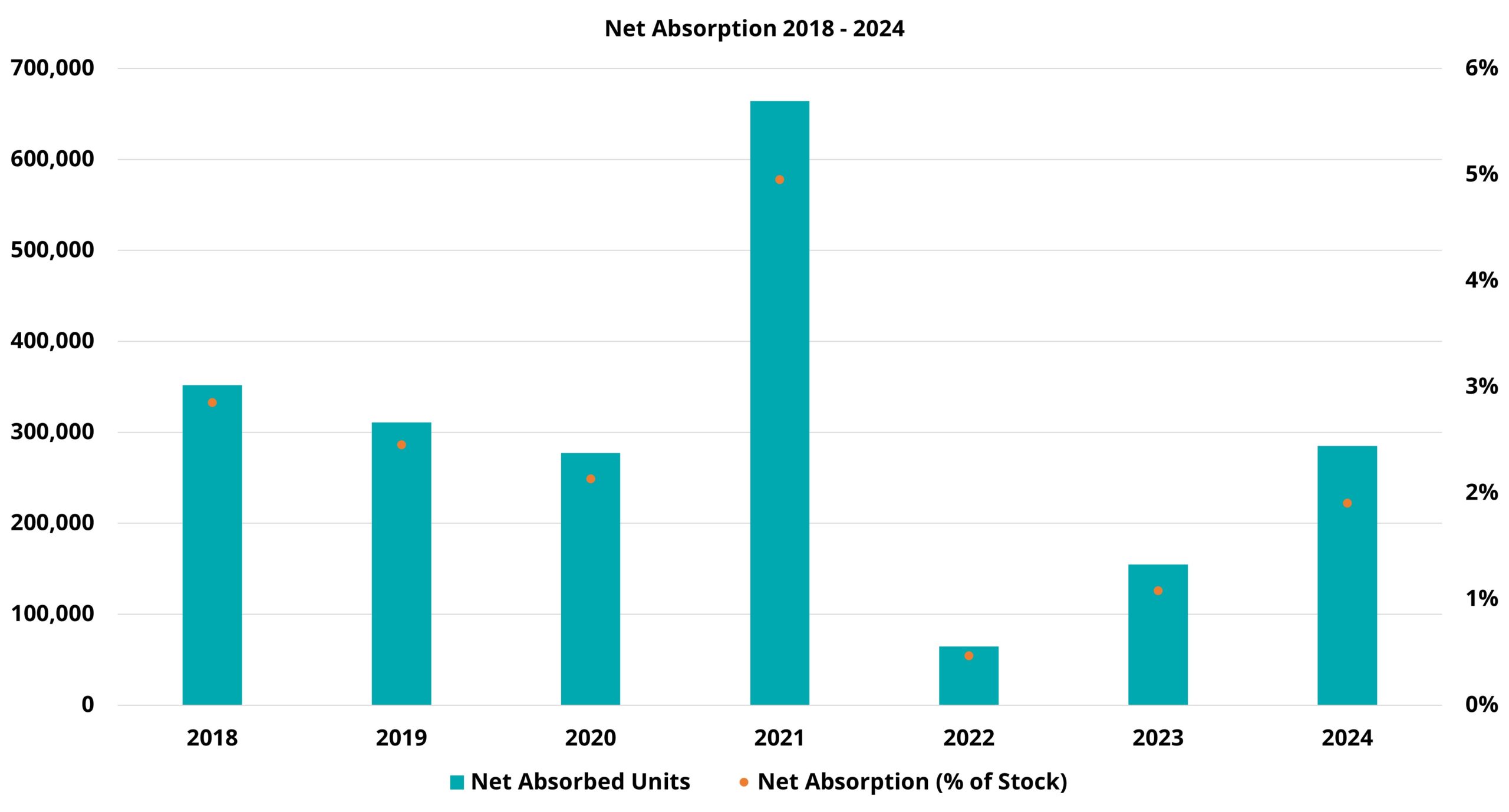

The multifamily industry made significant strides in 2024, showcasing resilience amid challenges. Despite historic new supply pressures, the decline in national average occupancy was smaller than in 2022 or 2023. Net absorption posted robust annual improvements for the second consecutive year, and effective rent growth for new leases more than doubled the lackluster performance of 2023. Lease concession availability also increased, though at a slower pace than in previous years.

While progress was evident, challenges remain. National average occupancy ended 2024 at its lowest point in years, marking the third straight year of decline. Average rent growth, though improved, remained under 3%, and net absorption, despite gains, lagged pre-pandemic levels. Over the past five years, national stock has expanded by approximately 2.3 million units, underscoring the urgency of aligning supply with demand.

Note: All figures refer to conventional properties with at least 50 units.

New Supply Outlook for 2025

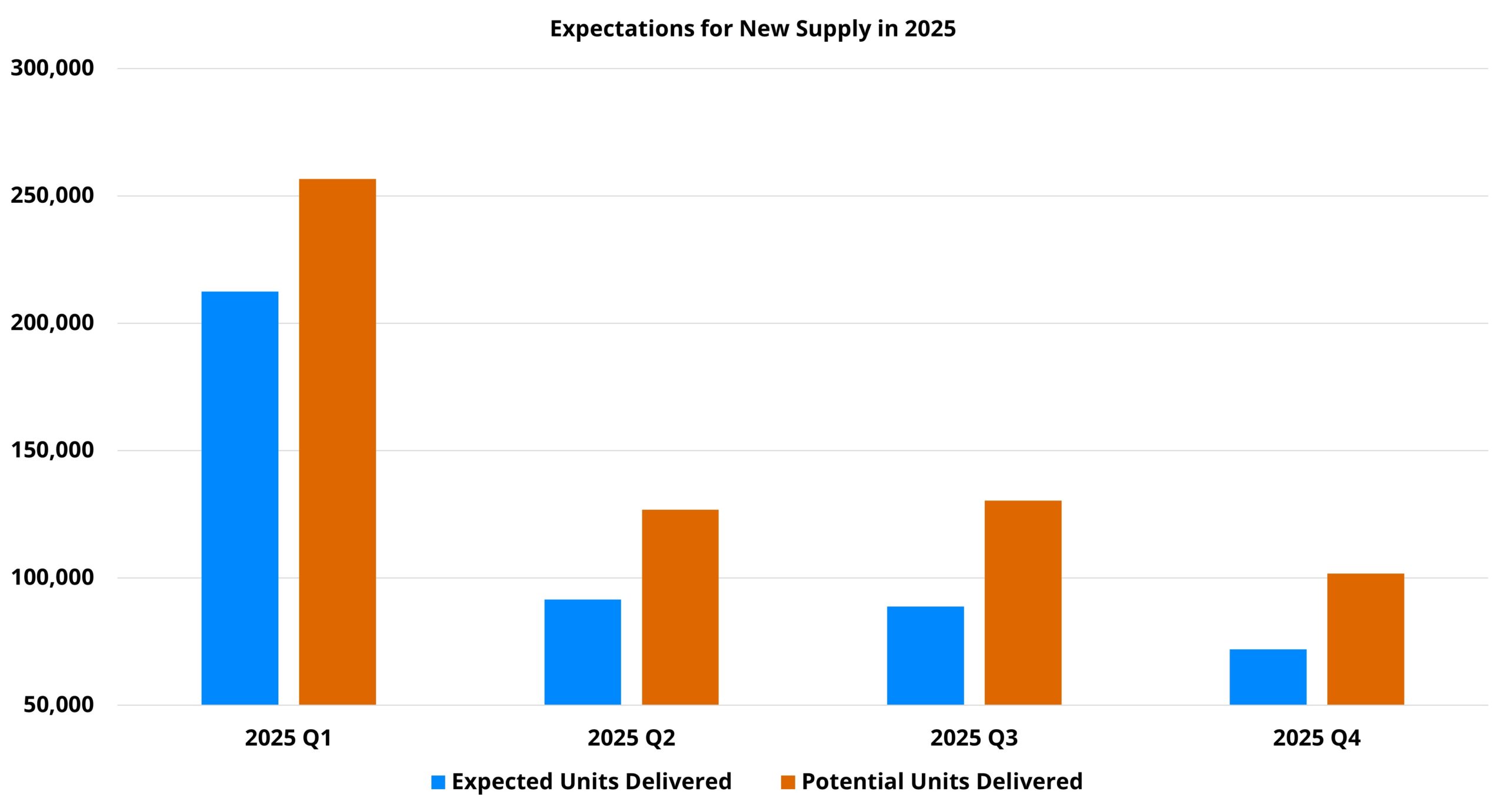

New supply will continue to influence multifamily performance in 2025. Although fewer units are expected to be delivered than in 2024, the margin remains uncertain due to potential shifts in project timelines.

Currently, approximately 465,000 units are slated to begin leasing in 2025, based on construction trends. However, if average construction durations decrease, new supply could exceed 600,000 units, slightly surpassing 2024 levels. Notably, the decline in permits and starts reported in 2024 will likely impact the industry in 2026 or 2027.

Regional shifts are anticipated as Sunbelt markets like Atlanta, Dallas-Fort Worth, and Tampa, which have led in new supply, begin to cool. Other areas, including Houston, Austin, and Orlando, may see smaller declines in deliveries. Meanwhile, Gateway markets such as Los Angeles, New York, and San Francisco are poised for increased activity, alongside California markets like San Diego and Sacramento.

Household Formation and Composition

Household formation remains a pivotal driver of multifamily demand. According to Census Bureau data, household growth over the past three years was the strongest since 2014–2016. However, long-term trends show a decline in both percentage growth and total households added.

In 2024, 57% of adults aged 18–24 and 16% of those aged 25–34 lived with their parents, reflecting significant demand potential under favorable economic conditions. This cohort, comprising over 20 million individuals, represents a key segment for future apartment demand.

Apartment Demand vs. New Supply

While apartment demand has improved, it remains insufficient to match the pace of new supply. In 2024, net absorption rose 84% year-over-year to 285,000 units, a notable recovery from the lows of 2022 but still below pre-pandemic levels.

Encouragingly, demand gains were seen across all price classes, with Class D properties finally turning a corner. The Sunbelt remains a demand hub, with migration trends favoring states like Florida, Texas, and Arizona. Secondary and tertiary markets also showed promise, benefiting from steady fundamentals and favorable migration patterns.

Occupancy and Rent Growth

National occupancy has been under pressure, declining from a peak of nearly 95% in late 2021 to about 88% at the end of 2024. Stabilized property occupancy showed modest improvement, rising 0.4% in 2024. However, further declines in national occupancy are expected in 2025, albeit at a slower rate than in prior years.

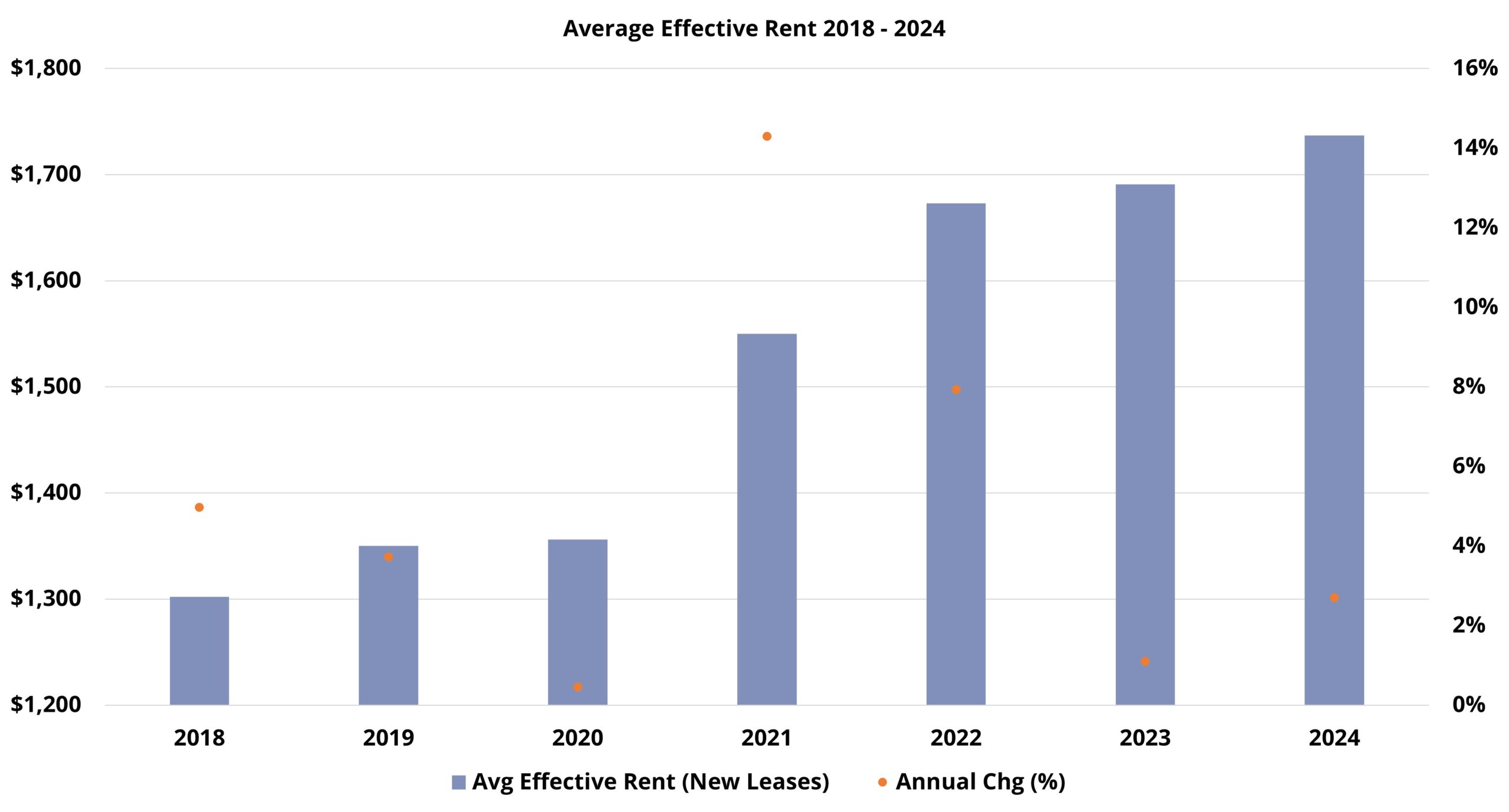

Rent growth is showing signs of recovery. After a minimal 1.1% increase in 2023, rents grew by 2.7% in 2024. Continued improvement in net absorption and reduced new supply pressure could drive further rent growth, particularly in workforce housing segments (Class C and D). Secondary and tertiary markets are also expected to maintain stronger rent performance compared to primary markets.

Key Takeaways

The multifamily industry has made steady progress over the past two years. While 2024 marked an improvement in rent growth and demand, challenges like declining occupancy and excess supply persist.

The outlook for 2025 is cautiously optimistic:

- New supply is likely to decline or stabilize.

- Apartment demand should continue to grow.

- Rent growth is poised to strengthen across various segments.

- Occupancy may stabilize, but a recovery is more likely in 2026.

Risks, including construction delays, geopolitical tensions, and economic uncertainties, remain. However, 2025 begins with more optimism for the multifamily sector than in recent years.

Disclaimer: All content and information in this article is for informational purposes only. ALN Apartment Data makes no representations about the accuracy or completeness of the information. The owner is not liable for losses, injuries, or damages resulting from the use of this information. Content may be shared provided proper attribution and a link to the original article or website.