St. Petersburg Commits $4.5M to Affordable Housing in Skyway Marina Mixed-Use Project

April 21, 2025

Boutique Hotel to Replace Storm-Damaged Tower in Downtown St. Pete Clears First Hurdle

April 30, 2025The Peak is Past: A Shift in Apartment Supply

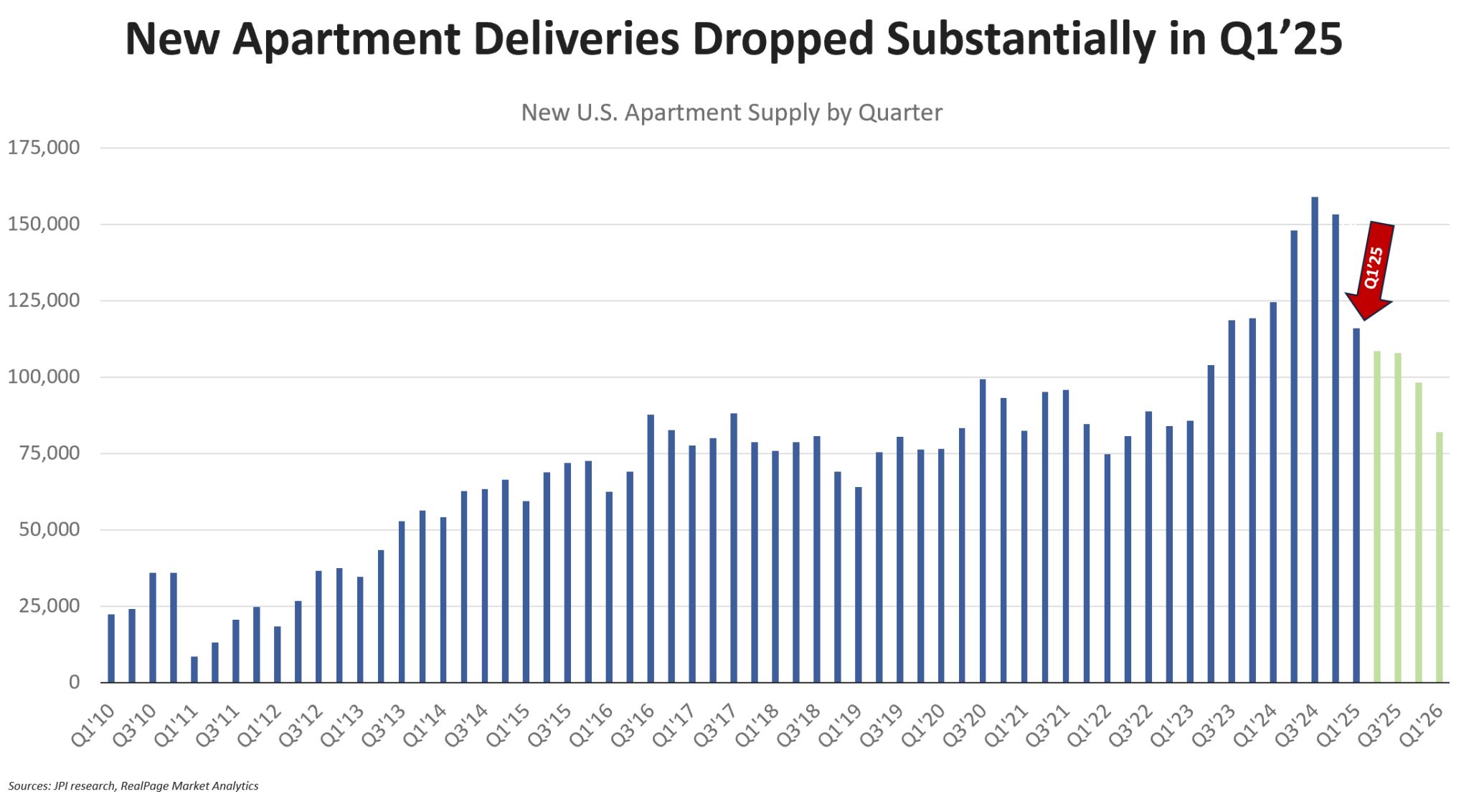

The historic peak in U.S. apartment supply is officially behind us. Completions dropped to 113,000 units in Q1 2025—a sizable number by any measure, but well below the ~150,000 units delivered in each of the previous three quarters.

To be clear, there’s still a significant amount of supply to absorb this year, especially over the next six months. Completions are expected to fall off sharply in the second half of 2025. While full-year supply will remain elevated in most markets—albeit with a few exceptions—the longer-term picture tells a different story.

Thanks to a dramatic drop in new starts over the past couple of years, the construction pipeline is rapidly thinning. Data from RealPage and CoStar both point to subpar new supply levels in 2026—potentially dipping below 300,000 units nationally. That would take us back to levels more common in the mid-2010s than the late 2010s. What’s more, a larger-than-usual share of that new supply is expected to include workforce or affordable housing, as projects with subsidies or abatements are more likely to pencil in today’s environment.

All of this sets the stage for a rebound in rent growth—if demand holds steady. That’s a big “if,” especially with rising concerns about a recession tied to escalating tariff tensions. Should a slowdown materialize, apartments (as well as SFR and BTR) won’t be immune—but they’re still likely to outperform many other commercial real estate sectors. The fundamentals of housing remain strong: low unemployment, high homeownership barriers, and favorable demographics all work in multifamily’s favor.

So, which markets are on track to see supply fall below pre-pandemic norms first? It’s a diverse list that spans every region:

Midwest: Chicago, St. Louis, Milwaukee, Minneapolis

Sun Belt/Mountains: Houston, Dallas, San Antonio, Denver, Nashville (with faster cooldown in the suburbs than the urban core)

Northeast/Mid-Atlantic: Baltimore, Pittsburgh

West Coast: Bay Area, Portland

Interestingly, some of these markets—especially in the Midwest and on the coasts—are already posting rent growth north of 3%. Even in higher-supplied metros, momentum is beginning to shift, setting the stage for faster-than-expected rebounds.

At the end of the day, it’s all about supply and demand. So far, demand has exceeded expectations. And while future demand carries some uncertainty, the supply trajectory is crystal clear: It’s going down—and that trend was well underway before tariffs re-entered the conversation. If anything, tariffs could extend the slowdown even further.

For a deeper dive into what’s ahead, check out The Rent Roll podcast featuring special guest—and Youngstown, Ohio’s finest—Lee Everett, EVP and Head of Research at Cortland. Lee’s insights are always sharp and never to be missed. - Article Source: The Rent Roll podcast by Jay Parsons