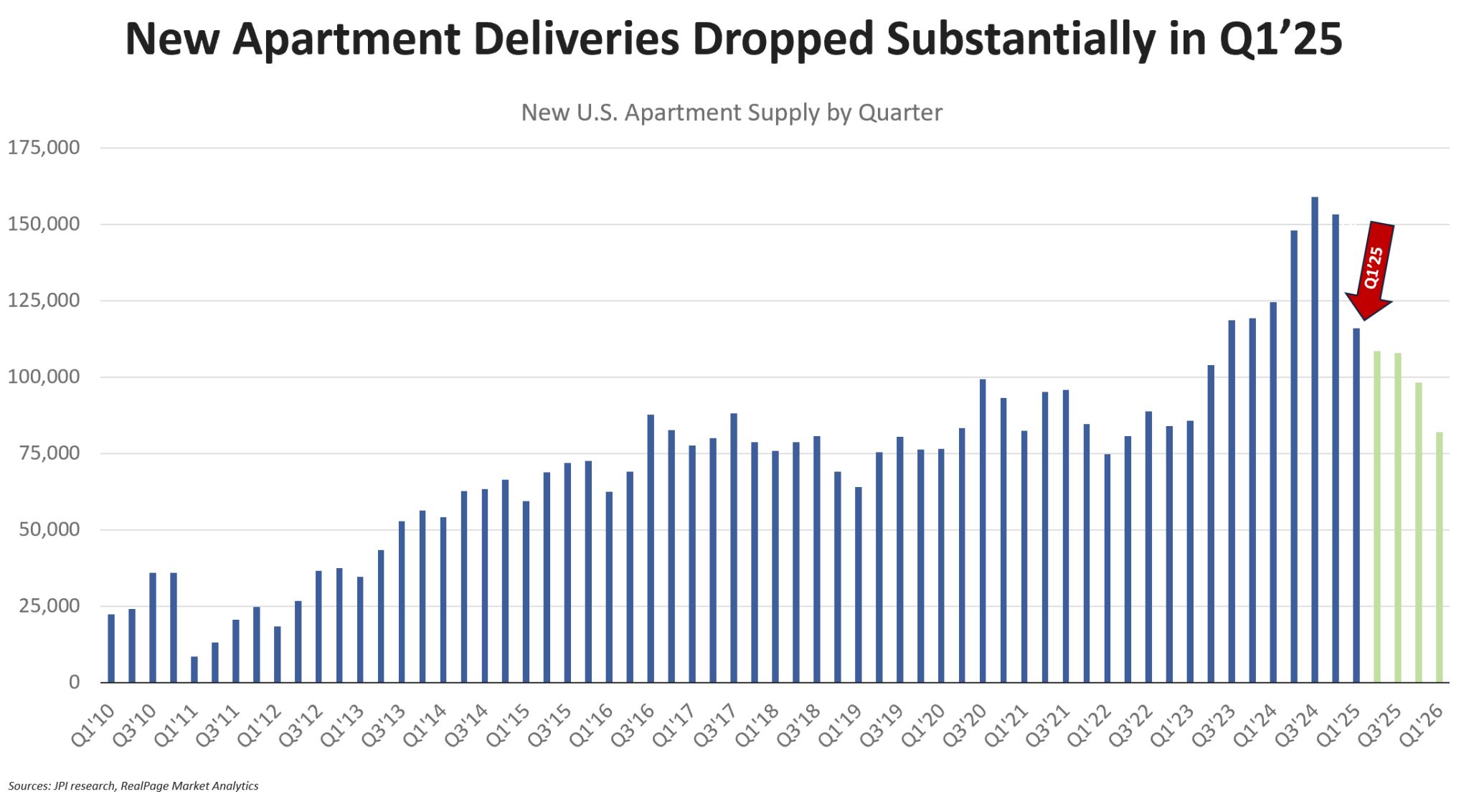

The Peak is Past: A Shift in Apartment Supply

April 23, 2025

Apartment Construction Hits 50-Year High—But a Slowdown Is Looming

May 16, 2025Boutique Hotel to Replace Storm-Damaged Tower in Downtown St. Pete Clears First Hurdle

Plans to demolish a storm-damaged tower at 300 Central Avenue and replace it with a 16-story boutique hotel received their first round of approvals from the City of St. Petersburg on Thursday.

Acting as the Community Redevelopment Agency (CRA), the St. Pete City Council unanimously agreed that the proposal by Gianco Cos. aligns with the city’s redevelopment goals. The project includes 74 hotel rooms and 4,000 square feet of commercial space. It now awaits site plan approval by the Development Review Commission (DRC) and final sign-off from the CRA.

The proposed hotel will rise slightly taller than the existing 11-story tower, which sustained heavy damage from Hurricane Milton. The application was submitted to the Downtown Review Commission on April 14 under a streamlined review process.

In downtown St. Pete, demolition typically requires plans for a replacement unless the building is declared substantially damaged. Either way, the existing structure at 300 Central is set to come down pending further approvals.

“One of the purposes of the Intown CRA is to reduce blight,” said Councilmember Gina Driscoll. “We’d like this particular blight to be reduced sooner rather than later. It’s a prime corner, and this project is going to be incredibly successful and popular—but what we’ve got now, it’s got to go.”

While awaiting approvals, Gianco Cos. is pursuing repairs to stabilize the existing structure, including permits for new netting to secure loose stucco. If officially deemed substantially damaged, the building will be demolished outright.

The boutique hotel will feature street-level retail—potentially including a restaurant and the hotel lobby—facing Central Avenue. Though the hotel’s brand has not been disclosed, Gianco Cos. CEO Steve Gianfilippo described it as a luxury property designed to reflect the character and spirit of St. Pete.

Plans call for eight guest rooms per floor on levels three through seven, four per floor on levels eight through fifteen, and two rooms on the top floor. Outdoor amenities include a ground-level covered area, an eighth-floor deck, and a rooftop terrace.

Parking, however, emerged as a concern. The current plan includes just 23 spaces—one per four hotel rooms and one per 1,000 square feet of retail. Several council members voiced worry about adding pressure to downtown’s already limited parking and infrastructure.

The project team is working on a potential agreement to use the adjacent garage at 360 Central Avenue and may also lease spaces in the McNulty Lofts Garage, which Gianfilippo owns through another venture.

“We need to be cognizant of parking,” said Councilmember Corey Givens. “But also of the strain on infrastructure—sewage capacity, utilities. With so many high-rises underway, we must think holistically.”

Architectural plans incorporate elements of the current building’s mid-century modern design. Although constructed in the early 1920s, preservationists consider that style a key part of the structure’s historical significance.

Design plans are still being finalized. Feedback from a recent downtown neighborhood association presentation was positive. Behar Peteranecz is serving as the project architect, with engineering by Kimley-Horn.

Gianco Cos. had considered a multifamily project but ultimately chose a hotel due to the growing number of residential units already downtown. “There is a gaping hole for this kind of hotel,” Gianfilippo said.

Next steps include review of the site plan by the DRC and submission to the Federal Aviation Administration for a no-hazard determination related to building height.