Boutique Hotel to Replace Storm-Damaged Tower in Downtown St. Pete Clears First Hurdle

April 30, 2025

Five Observations on the Impact (and Potential Impact) of Tariffs on Multifamily and BTR

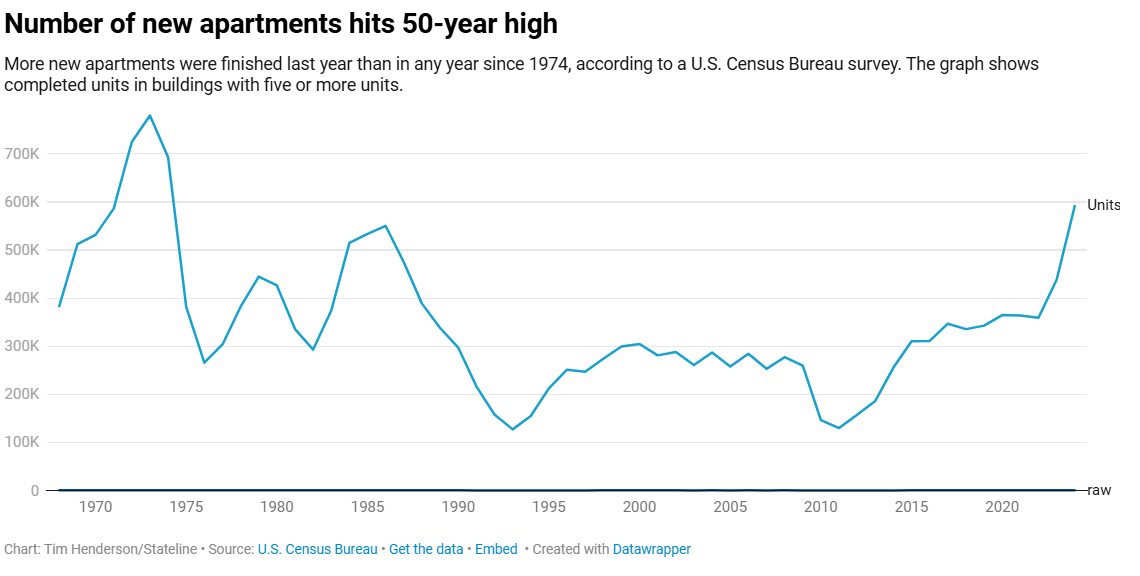

May 19, 2025Apartment Construction Hits 50-Year High—But a Slowdown Is Looming

Apartment construction surged to historic levels in 2024, with more new units completed than in any year since 1974. Yet experts warn the boom may be short-lived, as high interest rates, labor shortages, and tariffs threaten to cool the market.

According to a U.S. Census Bureau survey, nearly 592,000 new apartments were completed last year—the most since 1974, when the U.S. built 693,000 units amid a baby boomer housing rush. At that time, the U.S. had roughly half as many households as today.

However, the pipeline is shrinking fast. Despite high completion numbers, new apartment starts dropped 27% in 2024 compared to 2023, and 37% from the recent 2022 peak of 531,000 units. Starts are now at their lowest level since 2013.

The decline stems from multiple factors: increased supply has cooled rents and raised vacancy rates, reducing developers' incentives. At the same time, tariffs on building materials and reduced immigration—spurred by stricter enforcement policies—are making it harder to find workers and afford construction costs.

“We are going to be short of workers for a long time. That’s the way it is. And of course tariffs are going to have an impact,”

—Danushka Nanayakkara-Skillington, National Association of Home Builders

Supply and Demand Rebalancing

Much of the current influx of apartments was launched during the low-interest, high-rent-growth years of 2021 and 2022, said Rob Warnock, a senior research associate at Apartment List. Those projects came online in 2023 and 2024, contributing to falling rents and rising vacancies.

“Supply and demand are coming back into balance,” Warnock said.

Rents are now down about $50 per month (3.5%) from their 2022 peak, and vacancy rates have hit 6.3%, the highest in 15 years, according to Apartment List. However, Moody’s projects this trend could reverse as fewer new apartments are built in the coming years.

Ongoing Housing Shortage

Despite the construction boom, the U.S. still faces a housing shortage—particularly in high-demand, high-cost areas. Estimates vary widely, from 1.5 million to over 20 million missing units, though most experts, including Harvard’s Joint Center for Housing Studies, place the gap between 1.5 million and 5.5 million.

State-Level Trends and Political Responses

States vary widely in their response to the housing shortage. A Stateline analysis found that South Dakota, Utah, Arizona, and Colorado have had the highest rates of apartment permitting, while Mississippi, Wyoming, West Virginia, Rhode Island, Oklahoma, and Alaska lag far behind.

South Dakota, for instance, approved nearly 6,000 apartment unit permits in 2023 and 2024, which would add 1.4% to its 2023 housing stock of 417,000 units—the highest growth rate in the country. Mississippi, by contrast, approved only about 660 units during the same period.

To support growth, South Dakota’s Republican-led legislature created the Housing Infrastructure Financing Program, investing $200 million in grants and loans for critical development infrastructure such as roads and sewer systems.

“South Dakota businesses need more workers. To get more workers, we need more housing.”

—State Sen. Casey Crabtree (R)

Regulatory and Political Barriers

In Democratic-controlled states, regulatory hurdles such as zoning restrictions and impact fees are often cited as major obstacles to housing development.

“A lot of blue-government areas have extremely restrictive zoning, impact fees, and other rules that make it very difficult to build,”

—Armand Domalewski, co-founder of YIMBY Democrats for America

Domalewski added that in a truly free market, developers would build in high-demand states like California—but local opposition and regulation often prevent that.

California’s 2021 HOME Act was intended to encourage affordable housing construction and ease labor shortages. But local resistance has hampered its rollout. In response, Democratic Gov. Gavin Newsom signed a package of bills at the end of 2024 to reduce regulatory barriers and push back against local obstruction.

The Outlook Ahead

Apartment completions remain strong in early 2025, with 39,000 units finished in March, not far off from the 41,500 in March 2024—the largest March total since 1985.

Still, with financing costs high and labor tight, experts expect construction starts to slow further in the coming months. The true impact of state-level infrastructure investments—like those in South Dakota—has yet to be seen, as many projects remain under construction.

As housing experts continue to debate the best path forward, one thing is clear: the U.S. housing market remains deeply imbalanced, with demand still outpacing supply in many parts of the country.