40 Years of Growth: Home Prices Surpass Income Gains

September 5, 2025

FAA 2025 Annual Conference & Trade Show

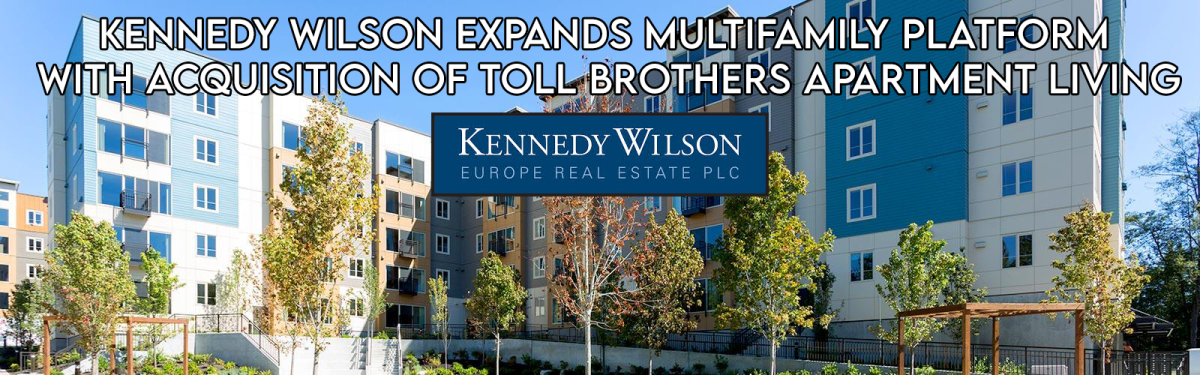

September 30, 2025Kennedy Wilson Expands Multifamily Platform with Acquisition of Toll Brothers Apartment Living

Kennedy Wilson, a global leader in real estate investment and development, has announced a definitive agreement to acquire Toll Brothers Apartment Living (TBAL), the multifamily development division of Toll Brothers. The $347 million transaction includes TBAL’s in-house development team, a portfolio of operating assets, and a robust pipeline of projects currently in various stages of construction and planning. Closing is anticipated in October, subject to customary conditions.

Through this acquisition, Kennedy Wilson will assume general partner interests in 18 multifamily and student housing communities across nine states, representing approximately 6,000 units and $2.2 billion in assets under management (AUM). This strategic move not only expands Kennedy Wilson’s footprint across the East Coast but also strengthens its position as a national player in rental housing.

Equally significant is the addition of 29 development sites under contract, which, once built out, are expected to represent roughly $3.6 billion of invested capital. Kennedy Wilson will also take on construction management responsibilities, further enhancing its vertically integrated capabilities across development, acquisitions, and asset management.

Beyond the immediate portfolio, Kennedy Wilson will manage an additional 20 apartment and student housing communities on behalf of Toll Brothers, representing another $3 billion in AUM. Toll Brothers has indicated plans to exit the multifamily sector over time, with Kennedy Wilson stepping in as a long-term steward of these assets.

A key element of the transaction is the transition of TBAL’s seasoned management and development team. Kennedy Wilson has expressed its commitment to retaining employees and leveraging their expertise to scale operations and grow the pipeline of multifamily housing nationwide.

William McMorrow, chairman and CEO of Kennedy Wilson, described the acquisition as a milestone moment:

“The addition of the Toll Brothers Apartment Living platform significantly accelerates the growth of our investment management business and our multifamily development capabilities at a time when high-quality rental housing is in great demand across the country. This acquisition creates a premier national platform of more than 80,000 units under ownership, financing, or management.”

The acquisition structure includes an initial $90 million investment by Kennedy Wilson in the acquired interests, with the balance of the transaction funded through existing partner relationships. J.P. Morgan Securities and Latham & Watkins advised Kennedy Wilson, while Goldman Sachs, Vestra Advisors, and Fried, Frank, Harris, Shriver & Jacobson represented Toll Brothers.

The partnership also sets the stage for future collaboration. Kennedy Wilson will continue to refer for-sale housing opportunities to Toll Brothers, while Toll Brothers will channel rental housing prospects back to Kennedy Wilson—demonstrating a mutually beneficial alignment as both companies focus on their respective strengths.

Douglas C. Yearley Jr., chairman and CEO of Toll Brothers, emphasized the strategic realignment:

“This transaction unlocks significant capital for our shareholders and allows us to sharpen our focus on our core homebuilding business. At the same time, we are confident that the TBAL team and assets will thrive under Kennedy Wilson’s leadership.”

This deal follows a trend of national homebuilders divesting large multifamily platforms. In 2024, KKR purchased an 18-property portfolio from Quarterra Multifamily, the rental housing division of Lennar, for approximately $2.1 billion.