Tampa General Expands Medical District Campus with $22 Million Property Acquisition

November 5, 2025

Skanska Delivers 400-Unit Marina Club Apartments on Former Skyway Marina Mall Site

November 14, 2025What to Expect in the Multifamily Industry in 2026 — Outlook & Actionable Takeaways

The multifamily sector heads into 2026 from a position of cautious optimism. After a multi-year surge of new deliveries and an era of higher interest rates, the market is moving from a supply-shock recovery phase toward a more balanced cycle. For owners, operators, and investors, 2026 looks like a year of regional winners and losers, modest rent recovery, and a premium on operational efficiency and capital discipline. Below I summarize the major trends to watch and practical steps to prepare your portfolio.

1. Supply & vacancy: the wave of completions has peaked — balance returns

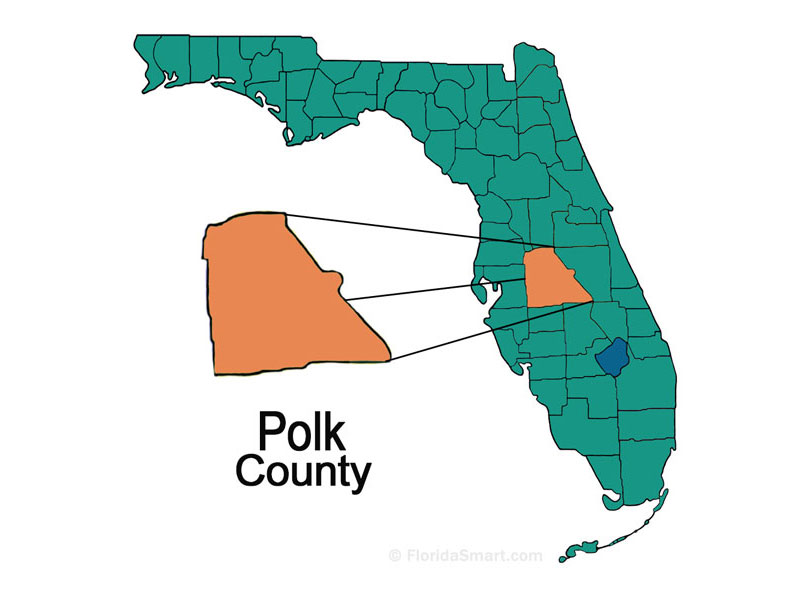

2024–2025 saw exceptionally high levels of new apartment deliveries (one source called 2024 a 40-year high). Expected completions taper into 2026 as groundbreakings slowed in 2025, which should relieve some of the downward pressure on occupancy and rents created by the recent influx of units. Markets that absorbed more of those units earlier will stabilize sooner, while Sun Belt and Mountain markets with heavy recent deliveries will see slower recoveries.

2. Rents: modest, uneven growth (not the old double-digit boom)

Most forecasts point to modest positive rent growth in 2026 rather than a return to the frenetic gains of 2021–2022. Analysts expect rent growth to accelerate from the flat-to-modest levels of 2024–2025 as vacancy normalizes, but the pace will be uneven by region and product type—best-performing metros and well-amenitized, newly renovated assets should lead. Expect markets that were oversupplied to lag, while tighter markets may post stronger gains.

3. Interest rates & capital markets: stabilization will matter more than a big drop

Financing conditions are the wild card. Many institutional forecasts envision rates moderating through 2026 (which would help valuations and transaction volume), but elevated rates compared with the pre-2022 era will keep underwriting conservative. That means cap rates and deal structures will remain sensitive to macro moves: expect selective buying, more creative financing, and a continued premium for stabilized, low-leverage properties.

4. Investment activity: more selective, but opportunistic

With cap rate compression opportunities limited and debt underwriting strict, investors will favor assets with steady cash flows, proven rent potential (via renovations or repositioning), and markets with structural demand. Value-add plays that can drive NOI through targeted interior renovations, upgraded amenities, or utility efficiencies will remain attractive—especially where capex can materially raise rents or reduce operating costs.

5. Demand drivers: demographics, migration, and affordability

Underlying demand remains supported by demographic tails: slow household formation catch-up, continued preference (for many) of renting vs buying in high-cost markets, and migration flows to Sun Belt metros. Affordability constraints in the for-sale market could sustain rental demand if mortgage rates fall only gradually. However, where new supply and migration mismatch, outcomes will vary.

6. Cost pressures & construction: labor, materials, and capex planning

Construction cost inflation has moderated from its pandemic peak but remains a major factor for ground-up development and renovations. For owners, tightening the capital plan, phasing unit renovations to capture rent bumps, and locking in contractor scopes and pricing where possible are practical ways to protect returns in 2026.

7. Technology, ESG, and resident experience continue to differentiate

Investors increasingly reward properties that lower operating costs and improve resident retention. Energy efficiency upgrades, water/utility metering, smart property management tools, and amenity investments that increase retention or justify higher rents will be priorities. Additionally, data-driven leasing and AI tools for pricing and maintenance will be a competitive advantage for operators who adopt them effectively.

Practical playbook — what owners/operators should do now

Stress-test debt and cashflow scenarios. Run upside and downside rent/occupancy scenarios and model refinancing paths. Prioritize assets with optionality.

Prioritize ROI-positive renovations. Target upgrades that demonstrably raise rents or retention (kitchens, bathrooms, utility efficiency, package/EV infrastructure). Value-add remains a dominant strategy when cap rates and borrowing are tight.

Right-size new development pipelines. If you’re a developer, be conservative: elevated construction and financing costs mean longer hold periods and higher carry risk. Phased delivery reduces exposure.

Leverage data and automation. Dynamic pricing tools, predictive maintenance, and resident portals reduce operating expense and vacancy days—small savings compound across large portfolios.

Watch regional signals, not just national headlines. Local supply pipelines, job growth, and migration patterns will determine winners; one-size national outlooks mask this granularity.

Bottom line

2026 looks like a year of normalization for multifamily: supply pressures ease, rent growth resumes at a modest clip, and capital markets become more discerning. Success will go to operators who combine careful underwriting with tactical capital deployment—especially on renovations and efficiency upgrades that unlock immediate NOI. Markets and submarkets will matter more than ever; granular, data-driven strategies and disciplined capex plans will separate the outperformers from the rest.